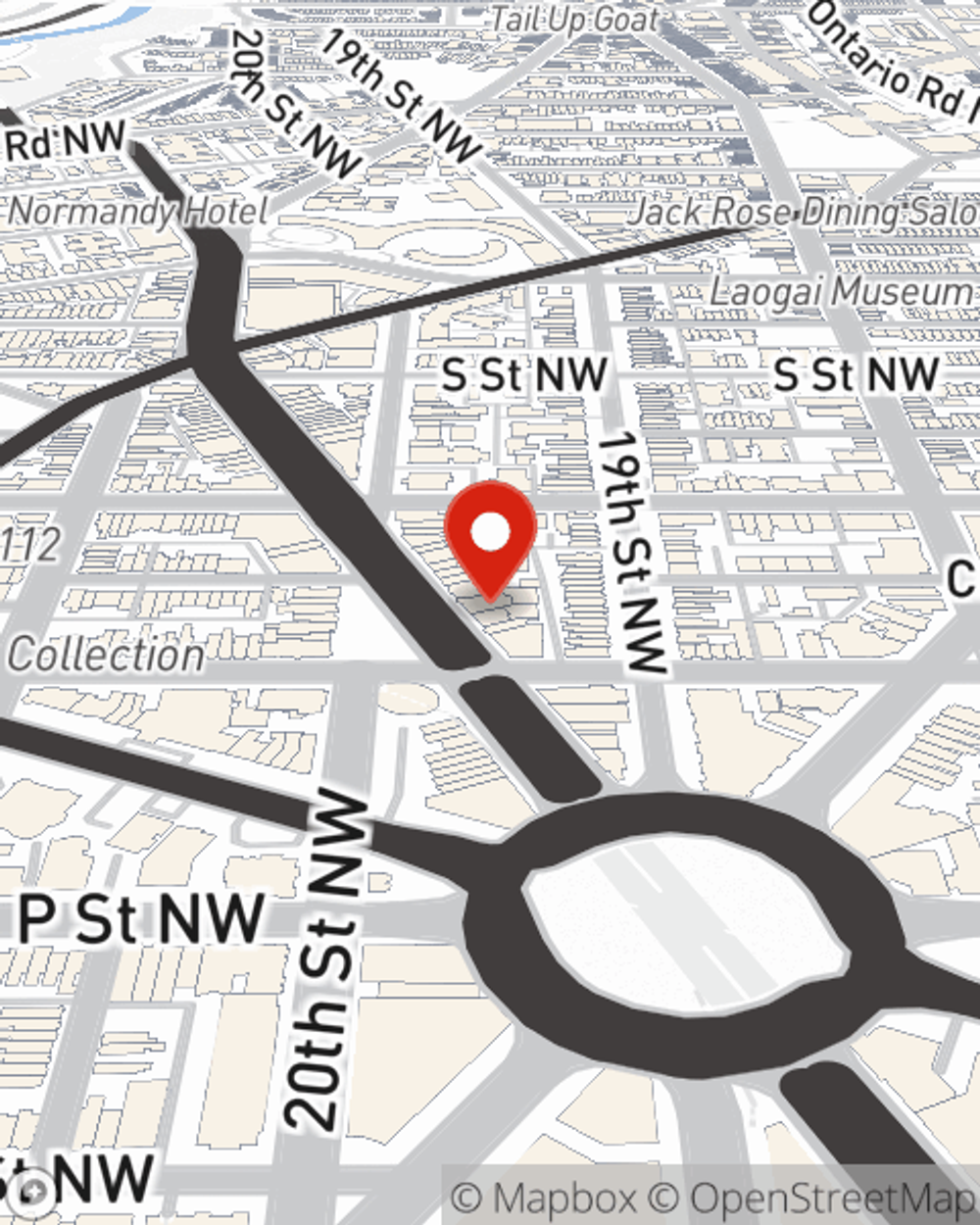

Business Insurance in and around Washington

Washington! Look no further for small business insurance.

No funny business here

Would you like Paul to create a personalized business quote?

This Coverage Is Worth It.

Running a small business requires much from you. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, trades, contractors and more!

Washington! Look no further for small business insurance.

No funny business here

Surprisingly Great Insurance

When one is as enthusiastic about their small business as you are, it makes sense to want to make sure everything is in order. That's why State Farm has coverage options for surety and fidelity bonds, business owners policies, commercial liability umbrella policies, and more.

Let's talk business! Call Paul Dougherty today to see why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.